Cape Coral represents one of Southwest Florida's most compelling real estate investment opportunities, combining rapid growth, strategic location, and exceptional value proposition. As one of the fastest-growing cities in Florida, Cape Coral has emerged as SWFL's premier destination for both primary residences and investment properties, offering investors unique advantages in an increasingly competitive market.

🏡 Meet Your Cape Coral Real Estate Expert

Get expert guidance from a local Cape Coral investment specialist

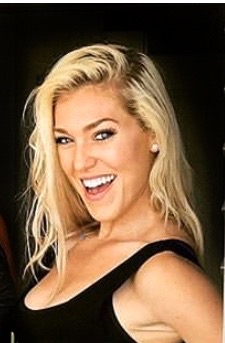

Christina Rodriguez

Cape Coral Real Estate Expert & Airbnb Specialist

Marzucco Real Estate

Specializations:

- Cape Coral Investment Properties

- Vacation Rental & Airbnb Properties

- Market Analysis & ROI Optimization

- Waterfront & Canal Properties

Ready to invest in Cape Coral? Christina has helped dozens of investors find profitable properties in SWFL's hottest market. Get your free market analysis today!

🎯 Why Cape Coral is SWFL's Investment Hotspot

- Rapid Growth: Fastest-growing city in Southwest Florida with 15%+ population increase

- Value Proposition: 20-30% lower prices than Naples and Fort Myers Beach

- Infrastructure Development: Major improvements in roads, utilities, and amenities

- Vacation Rental Demand: Strong short-term rental market with high occupancy rates

- Waterfront Living: 400+ miles of canals offering unique lifestyle appeal

- Strategic Location: Close to beaches, airports, and major SWFL attractions

📊 Cape Coral Market Overview 2025

Cape Coral's real estate market demonstrates remarkable resilience and growth potential, with property values appreciating consistently while maintaining affordability compared to other Southwest Florida markets. The city's strategic position between Fort Myers and Naples, combined with unique waterfront lifestyle offerings, creates compelling investment opportunities across multiple property types and price ranges.

🏠 Property Types & Investment Opportunities

🌊 Waterfront Properties - Premium Investment

Investment Range: $500K - $1.5M+

- Gulf Access Homes: Direct ocean access with highest rental premiums

- Sailboat Water Properties: Deep water access ideal for larger vessels

- Canal Front Homes: Recreational boating with strong vacation appeal

- Freshwater Canals: More affordable waterfront with fishing opportunities

- ROI Potential: 8-12% annual returns with strong appreciation

🏡 Single Family Homes - Core Investment

Investment Range: $300K - $600K

- 3/2 Pool Homes: Ideal vacation rental configuration

- 4/3 Family Properties: Strong appeal for larger groups

- New Construction: Modern amenities with warranty protection

- Established Neighborhoods: Proven rental demand and stable values

- ROI Potential: 6-10% annual returns with steady growth

🏢 Investment Properties - Emerging Opportunities

Investment Range: $200K - $400K

- Condominiums: Lower entry point with strong rental demand

- Townhomes: Low maintenance with community amenities

- Duplex Properties: Multi-family income with owner-occupy options

- Fixer-Uppers: Value-add opportunities for experienced investors

- ROI Potential: 5-8% returns with significant upside potential

📈 Market Trends & Growth Drivers

🚀 Population Growth Impact

- Migration Patterns: 1,000+ new residents monthly from Northeast/Midwest

- Demographics: Baby boomers and remote workers driving demand

- Job Market: Growing employment in healthcare, tourism, and services

- Infrastructure: City investments keeping pace with growth demands

🏗️ Development & Infrastructure

- Road Improvements: Major arterial expansions and new connections

- Utility Upgrades: Enhanced water, sewer, and electrical systems

- Commercial Development: New shopping, dining, and entertainment venues

- Beach Access: Improved connections to Fort Myers and Sanibel beaches

🏖️ Tourism & Vacation Rental Market

- Seasonal Demand: Peak occupancy rates 85%+ during winter months

- Year-Round Appeal: Growing summer market with competitive rates

- Unique Position: Alternative to expensive beach destinations

- Amenity Appeal: Pools, canals, and proximity to attractions

🗺️ Best Cape Coral Neighborhoods for Investment

🌟 Northwest Cape Coral

Investment Focus: Luxury properties and new construction

- Higher-end homes ($400K-1M+)

- Gulf access waterfront available

- Newer infrastructure and amenities

- Strong appreciation potential

💰 Southwest Cape Coral

Investment Focus: Value properties with growth potential

- More affordable entry points ($250K-500K)

- Established rental market

- Close to shopping and dining

- Good rental yield potential

⚓ Yacht Club Area

Investment Focus: Waterfront luxury investments

- Premium waterfront properties

- Golf course communities

- Established luxury market

- Strong vacation rental demand

🛣️ Pine Island Road Corridor

Investment Focus: Convenience and accessibility

- Easy access to amenities

- Mix of property types

- Growing commercial development

- Transportation improvements

💹 ROI Analysis & Financial Projections

📊 Vacation Rental ROI Breakdown

Sample Investment: $450K Cape Coral Pool Home

- Annual Rental Income: $45,000-55,000 (10-12% gross yield)

- Operating Expenses: $18,000-22,000 (40% of gross income)

- Net Cash Flow: $27,000-33,000 annually

- Property Appreciation: 5-8% annually (conservative estimate)

- Total Annual Return: 11-15% combining cash flow and appreciation

🏊 Cape Coral vs. Other SWFL Markets

| Market | Median Price | Rental Yield | Appreciation | Entry Barrier |

|---|---|---|---|---|

| Cape Coral | $425K | 10-12% | 7.2% | Moderate |

| Naples | $650K | 6-8% | 6.5% | High |

| Fort Myers Beach | $750K | 8-10% | 8.1% | Very High |

| Bonita Springs | $525K | 7-9% | 6.8% | High |

| Estero | $475K | 8-10% | 7.0% | Moderate-High |

⚠️ Market Risks & Considerations

🎯 Investment Risk Assessment

- Hurricane Risk: Southwest Florida location requires comprehensive insurance

- Market Saturation: Growing vacation rental supply may impact yields

- Interest Rates: Rising rates could affect affordability and demand

- Economic Sensitivity: Tourism-dependent market vulnerable to recessions

- Regulatory Changes: Local STR regulations could impact rental strategies

- Infrastructure Lag: Rapid growth sometimes strains city services

🔮 Future Market Outlook 2025-2030

📅 5-Year Market Projections

Growth Catalysts:

- Population Growth: Projected 25% increase by 2030

- Infrastructure Investment: $500M+ in planned improvements

- Commercial Development: Major retail and entertainment projects

- Transportation Access: Enhanced connectivity to region

- Tourism Growth: Southwest Florida visitor increases

Conservative Projections:

- Property Values: 5-7% annual appreciation

- Rental Demand: Sustained high occupancy rates

- Population: 250K+ residents by 2030

- Market Maturation: Continued but moderated growth

💡 Investment Strategy Recommendations

🎯 Expert Investment Tips

- Start with Research: Analyze specific neighborhoods and property types

- Work with Locals: Partner with experienced Cape Coral real estate professionals

- Consider Timing: Market cycles affect both purchase prices and rental demand

- Diversify Strategy: Mix of appreciation and cash flow focused properties

- Plan for Growth: Buy in areas with infrastructure development

- Understand Regulations: Research STR rules and HOA restrictions

- Budget Conservatively: Account for repairs, vacancies, and management

- Long-term Perspective: Best returns come from 5+ year holds

🏁 Getting Started in Cape Coral Real Estate

Cape Coral presents exceptional real estate investment opportunities for those seeking to capitalize on Southwest Florida's continued growth and appeal. The combination of affordability, strong rental demand, infrastructure development, and strategic location creates a compelling case for investment consideration.

Success in Cape Coral real estate investment requires thorough market knowledge, careful property selection, and realistic financial projections. While the market offers significant upside potential, investors should approach opportunities with appropriate due diligence and professional guidance to maximize returns while managing risks.

Ready to explore Cape Coral real estate investment opportunities? Our Southwest Florida experts can help you identify properties, analyze markets, and develop investment strategies tailored to your goals and risk tolerance. The Cape Coral market opportunity awaits informed and prepared investors.